Per hour salary calculator after tax

This means that the hourly rate for the average UK salary is 1504 per hour. Save money on taxes and see how Income Tax and National Insurance affect your income.

Paycheck Calculator Take Home Pay Calculator

This equates to a weekly salary of 77260 for a 38-hour work week.

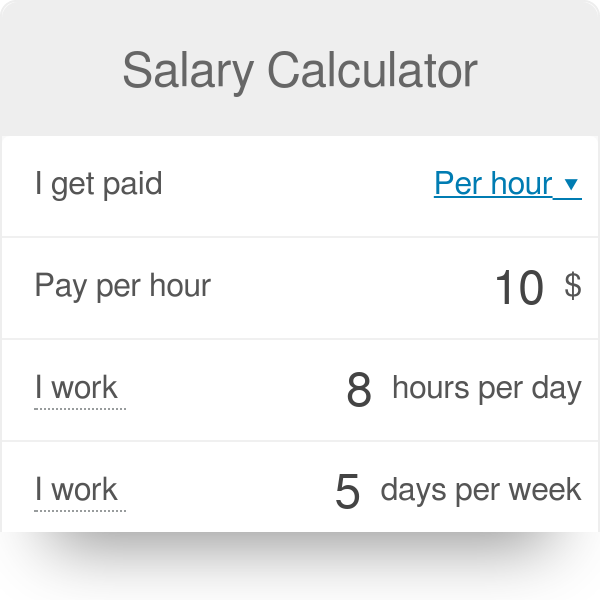

. US Tax Calculator and alter the settings to match your tax return in 2022. Your average tax rate is 270 and your marginal tax rate is 353This marginal tax rate means that your immediate additional income will be taxed at this rate. Multiply your hourly wage by the number of work hours per day.

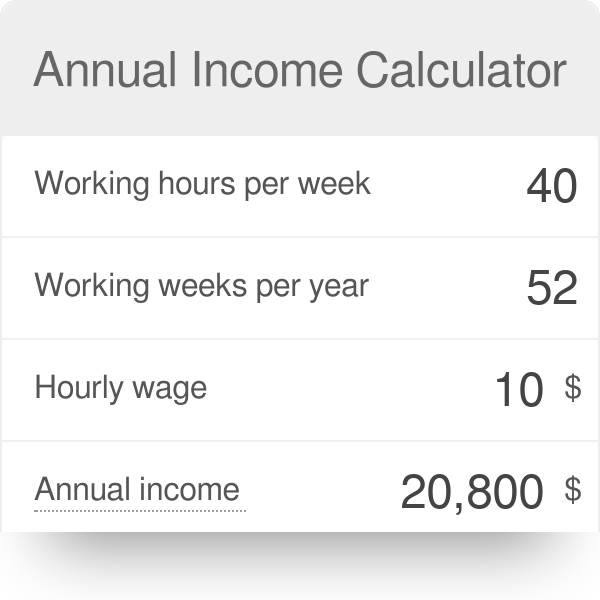

This 40k after tax salary example includes Federal and State Tax table information based on the 2022 Tax Tables and uses Idaho State Tax tables for 2022The 40k after tax calculation includes certain defaults to provide a standard tax calculation for example the State of Idaho is used for calculating. US Tax Calculator and alter the settings to match your tax return in 2022. According to data from Statista the average salary in the UK is 31285Assuming they work 40 hours per week their hourly rate would be as follows.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043That means that your net pay will be 37957 per year or 3163 per month. Follow these simple steps to calculate your salary after tax in Austria using the Austria Salary Calculator 2022 which is updated with the 202223 tax tables. Tax lawyers handle a variety of tax-related issues for individuals and corporations.

This 50k after tax salary example includes Federal and State Tax table information based on the 2022 Tax Tables and uses Michigan State Tax tables for 2022The 50k after tax calculation includes certain defaults to provide a standard tax calculation for example the State of Michigan is used for. Those aged 23 and over should earn the National Minimum Wage of at least 891 per hour regardless of how theyre paid. Aside from the high earning city slickers there are plenty of Australians who get by on the national minimum wage of 2033 per hour.

This marginal tax rate means that your immediate additional income will be taxed at this rate. This 80k after tax salary example includes Federal and State Tax table information based on the 2022 Tax Tables and uses Arizona State Tax tables for 2022The 80k after tax calculation includes certain defaults to provide a standard tax calculation for example the State of Arizona is used for. Updated for tax year 2022-2023.

This 200k after tax salary example includes Federal and State Tax table information based on the 2022 Tax Tables and uses Colorado State Tax tables for 2022The 200k after tax calculation includes certain defaults to provide a standard tax calculation for example the State of Colorado is used for. US Tax Calculator and alter the settings to match your tax return in 2022. Work Experience in a Related Occupation.

US Tax Calculator and alter the settings to match your tax return in 2022. You can compare different salaries to see the difference too. Your average tax rate is 168 and your marginal tax rate is 269This marginal tax rate means that your immediate additional income will be taxed at this rate.

Use the simple annual salary sacrifice calculator or switch to the advanced annual salary sacrifice calculator to review employers national insurance payments income tax deductions and PAYE tax commitments. If you make CHF 50000 a year living in the region of Zurich Switzerland you will be taxed CHF 8399That means that your net pay will be CHF 41602 per year or CHF 3467 per month. Scroll down to see more details about your 65000 salary Income Income Period.

Multiply your daily salary Step 1 by the number of days you work per week. Your average tax rate is 212 and your marginal tax rate is 396This marginal tax rate means that your immediate additional income will be taxed at this rate. This 70k after tax salary example includes Federal and State Tax table information based on the 2022 Tax Tables and uses Florida State Tax tables for 2022The 70k after tax calculation includes certain defaults to provide a standard tax calculation for example the State of Florida is used for.

This 6k after tax salary example includes Federal and State Tax table information based on the 2022 Tax Tables and uses Idaho State Tax tables for 2022The 6k after tax calculation includes certain defaults to provide a standard tax calculation for example the State of Idaho is used for calculating. Use our salary calculator to check any salary after tax national insurance and other deductions. In our example your weekly salary would be 680 136 per day times 5 days per week.

For instance an increase of 100 in your salary will be taxed 2965 hence your net pay will only increase by 7035. 6154 per hour Typical Entry-Level Education. Use our UK salary calculator to find out how much you really earn.

Your average tax rate is 314 and your marginal tax rate is 384This marginal tax rate means that your immediate additional income will be taxed at this rate. 1H ago Ethereums Merge is live heres what you need to know. Your average tax rate is 165 and your marginal tax rate is 297.

60163 per week 366 hours per week 1504 per hour. This 56k after tax salary example includes Federal and State Tax table information based on the 2022 Tax Tables and uses Montana State Tax tables for 2022The 56k after tax calculation includes certain defaults to provide a standard tax calculation for example the State of Montana is used for. Your average tax rate is 345 and your marginal tax rate is 407This marginal tax rate means that your immediate additional income will be taxed at this rate.

Doctoral or professional degree. Continue reading to find out more about the minimum wage for Australia. Tax agency has been plagued by understaffing and poor customer service with many taxpayer calls going unanswered.

How to calculate your salary after tax in Austria. Your average tax rate is 154 and your marginal tax rate is 345This marginal tax rate means that your immediate additional income will be taxed at this rate. Your average tax rate is 392 and your marginal tax rate is 494This marginal tax rate means that your immediate additional income will be taxed at this rate.

In our example your daily salary would be 136 17 per hour times 8 hours per day. Salary After Tax. They may help clients navigate complex tax regulations so that clients pay the appropriate tax on items such as income profits and.

Full-time employees generally work for 35. If you make 40000 a year living in Finland you will be taxed 15680That means that your net pay will be 24320 per year or 2027 per month. If you make 50000 a year living in Australia you will be taxed 7717That means that your net pay will be 42283 per year or 3524 per month.

US Tax Calculator and alter the settings to match your tax return in 2022. If your salary is 65000 then after tax and national insurance you will be left with 46094This means that after tax you will take home 3841 every month or 886 per week 17720 per day and your hourly rate will be 3125 if youre working 40 hoursweek. If you make 300000 kr a year living in the region of Aabenraa Denmark you will be taxed 103464 krThat means that your net pay will be 196536 kr per year or 16378 kr per month.

You can calculate your Annual take home pay based of your Annual gross income salary sacrifice adjustment PAYE NI and tax for 202223. US Tax Calculator and alter the settings to match your tax return in 2022. If you make 52000 a year living in the region of Manitoba Canada you will be taxed 16332That means that your net pay will be 35668 per year or 2972 per month.

Enter Your Salary and the Austria Salary Calculator will automatically produce a salary after tax illustration for you simple. If you make 55000 a year living in the region of California USA you will be taxed 11676That means that your net pay will be 43324 per year or 3610 per month. US Tax Calculator and alter the settings to match your tax return in 2022.

What Is Annual Income How To Calculate Your Salary Income Financial Health Income Tax Return

Paycheck Calculator Take Home Pay Calculator

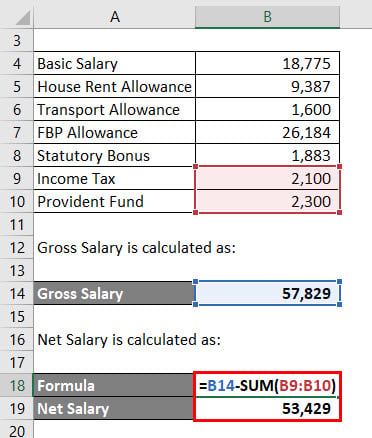

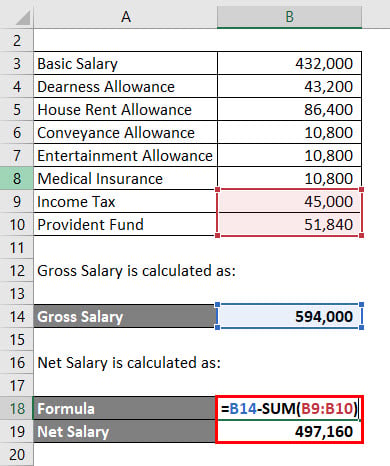

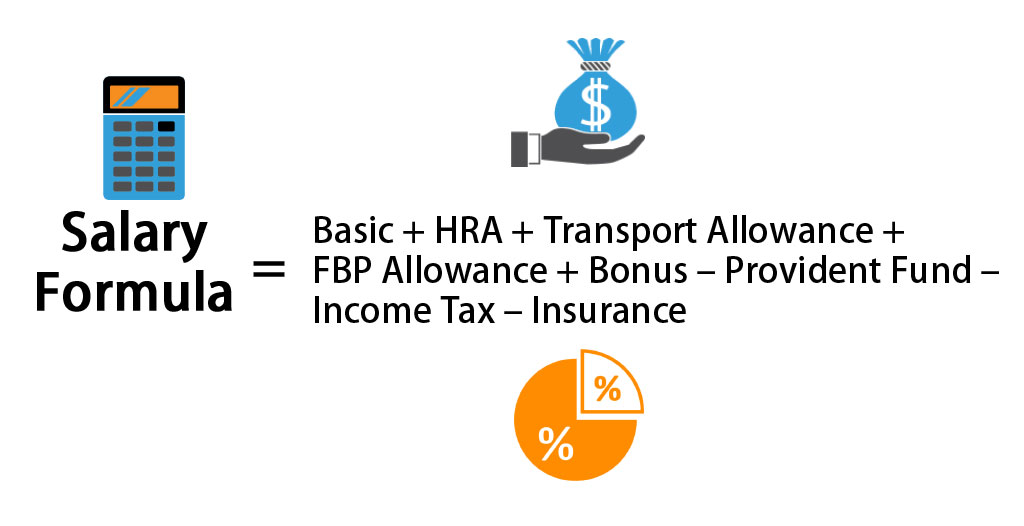

Salary Formula Calculate Salary Calculator Excel Template

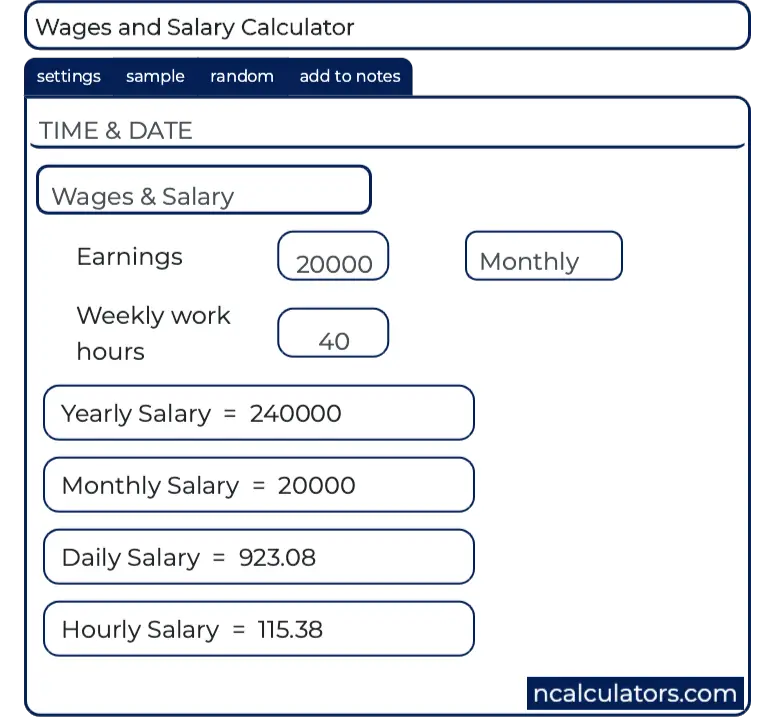

Wages And Salary Calculator

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Pay Calculator Salary

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Hourly To Salary What Is My Annual Income

Annual Income Calculator

Hourly To Annual Salary Calculator How Much Do I Make A Year

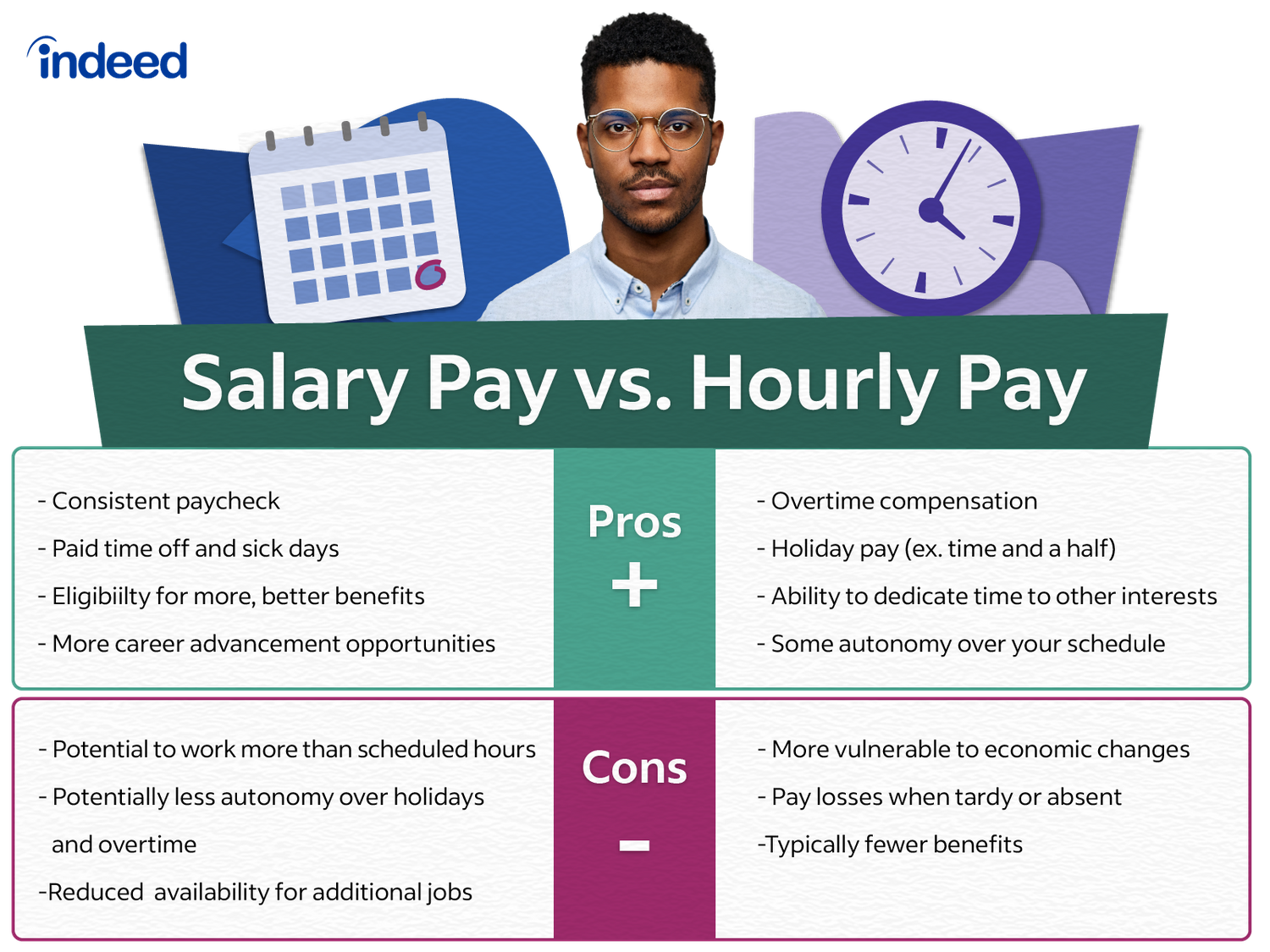

Hourly To Salary Calculator Convert Your Wages Indeed Com

Salary Formula Calculate Salary Calculator Excel Template

Salary Formula Calculate Salary Calculator Excel Template

Salary To Hourly Paycheck Calculator Omni Salary Budget Saving Paycheck

Salary Calculator

Hourly To Salary Calculator

Salary To Hourly Calculator

Annual Income Calculator